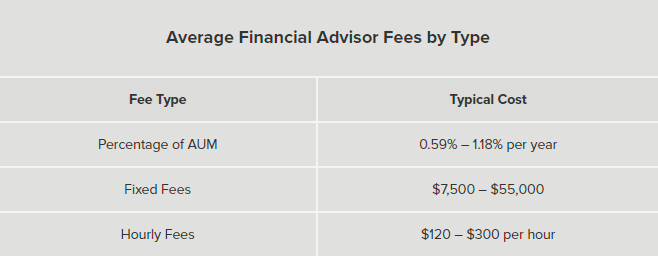

Can you afford a financial planner? The simple answer is: yes! In an earlier video I quoted a 2020 Fidelity Investments survey that found 71% of people felt they could do a lot better with financial matters. That’s not surprising, almost everyone wishes they could do better More importantly, only 29% of those even work with a financial planner! So, they know they could do better, but do nothing? Honestly, that’s like me trying to fix my sink. I have the tools, I know what parts I need, but I’ll probably mess it up instead of calling in a plumber. A plumber will save me time and save me money. Same goes for hiring a financial planner. In the same survey it was found that people who work with a financial planner have returns in excess of 1.5 – 4%. That excess offsets any fee an investor is trying to avoid by doing it themselves. If you compound those excess returns over 10 years, for example, a $10,000 investment would be worth $21,120 with a financial planner compared to $18,194 market return (I used a 6% market return and 7.5% return with the financial planner (6% + 1.5%) and compounded each monthly for 10 years). While, past performance is not guarantee, this is really just an example of the advantage you gain once you bring in a financial planner. I’ve also included a chart below of typical fees as noted by Advisor HQ in 2020. Its not as expensive as you might think and you just may end up in the 29% who think they are doing just fine financially (thanks to a financial planner!).